Customer data platforms (CDPs) unify customer data from multiple sources into a single database, enabling teams to build complete customer profiles and activate data across marketing, product, and analytics tools. Choosing the right CDP is critical because it becomes the foundation of your data infrastructure, affecting everything from customer segmentation to personalization capabilities.

This guide examines the top 10 CDP solutions, breaking down their key features, strengths, and ideal use cases to help you make an informed decision.

The top 10 CDPs at a glance

- Segment. Best for engineering teams prioritizing data reliability and flexibility.

- RudderStack. Best for teams wanting warehouse-native architecture and complete data ownership.

- Hightouch. Best for companies already invested in modern data warehouses.

- PostHog. Best for product teams wanting analytics and CDP capabilities in one platform.

- Polytomic. Best for technical teams needing flexible reverse ETL with strong API support.

- Jitsu. Best for developers wanting open-source event collection with simple deployment.

- Freshpaint. Best for healthcare and privacy-focused companies requiring zero-code tracking.

- mParticle. Best for mobile-first companies with complex multi-platform requirements.

- Lytics. Best for marketing teams focused on AI-driven customer intelligence.

- Tealium. Best for enterprises requiring tag management alongside CDP capabilities.

What is a customer data platform (CDP)?

A CDP collects customer data from websites, mobile apps, servers, and third-party tools, then transforms and routes that data to downstream destinations like analytics platforms, marketing automation tools, and data warehouses.

CDPs differ from traditional data infrastructure by providing real-time data collection, identity resolution across devices and platforms, and pre-built integrations with hundreds of tools. This enables teams to implement sophisticated customer data workflows without building custom pipelines for every integration.

How to evaluate customer data platforms

- Data collection and reliability. The platform should provide robust SDKs and APIs for collecting data from all your customer touchpoints. Look for features like automatic retries, data validation, and guaranteed delivery to prevent data loss.

- Identity resolution. Strong identity resolution capabilities merge user profiles across devices, sessions, and platforms. This becomes critical as users interact with your product through multiple channels.

- Integration ecosystem. Evaluate the breadth and depth of pre-built integrations. More importantly, assess how well the platform handles custom destinations and whether it supports the tools your team already uses.

- Data governance and compliance. Enterprise teams need features like PII filtering, consent management, and audit logs. Verify the platform meets your regulatory requirements for GDPR, CCPA, or industry-specific compliance.

- Developer experience. The quality of documentation, SDKs, and debugging tools directly impacts implementation time. Look for platforms that prioritize developer experience with clear error messages and testing environments.

Based on this criteria, we've shortlisted 10 solutions.

Segment

Segment is the market leader in CDPs, offering comprehensive data collection and routing with an extensive integration catalog. The platform provides robust SDKs for web, mobile, and server-side tracking, with features like schema validation and data quality monitoring.

Best for

Engineering teams at companies of all sizes who need reliable data collection with maximum flexibility. Segment works well for teams that want to avoid vendor lock-in by maintaining control over their data infrastructure while leveraging pre-built integrations.

Strengths

- Extensive integration catalog. Over 400 pre-built integrations covering analytics, marketing, data warehouses, and specialized tools. This breadth reduces integration development time significantly.

- Reliability and scale. Battle-tested infrastructure handles billions of events with strong delivery guarantees. The platform includes automatic retries and detailed delivery metrics.

- Developer-friendly tools. Excellent documentation, multiple SDK options, and a testing environment that makes implementation straightforward. The schema validation features catch data quality issues early.

- Flexible data pipeline. Functions and transformations enable data manipulation before it reaches destinations. This allows teams to normalize data formats and filter PII without custom infrastructure.

Limitations

- Price increases with scale. Segment's pricing is based on Monthly Tracked Users (MTUs), which can become expensive as your user base grows. Companies often hit unexpected cost increases as they scale.

- Complex pricing model. Understanding true costs requires careful analysis of MTU definitions and feature tiers. Additional features like Personas and Protocols require add-ons.

- Limited reverse ETL capabilities. While strong at data collection, Segment is less powerful for activating data from your warehouse compared to dedicated reverse ETL tools.

Pricing

Segment offers a free tier for up to 1,000 MTUs. Paid plans start around $120/month for the Team plan, with Business and Enterprise tiers requiring custom quotes. Pricing scales with MTUs, integrations, and additional features.

How it compares

Compared to RudderStack, Segment offers more integrations and a more mature product but at higher cost. Compared to mParticle, Segment has better developer tools but less sophisticated mobile-specific features. Compared to Hightouch, Segment is stronger at data collection but weaker at warehouse-to-tool activation.

RudderStack

RudderStack is an open-source CDP that stores event data in your own warehouse before routing it to destinations. This warehouse-native approach gives companies complete control over their customer data while still providing CDP capabilities.

Best for

Engineering teams that prioritize data ownership and warehouse-first architecture. RudderStack works well for companies already using modern data warehouses like Snowflake, BigQuery, or Redshift who want to maintain control over their data infrastructure.

Strengths

- Open-source foundation. Self-hostable option provides complete control over data and infrastructure. Teams can audit code, customize behavior, and avoid vendor lock-in entirely.

- Warehouse-native architecture. Events flow directly into your warehouse, creating a single source of truth. This simplifies data governance and enables sophisticated analysis using warehouse tools.

- Cost-effective scaling. Pricing based on events rather than MTUs often results in lower costs at scale. Companies with large user bases but moderate event volumes save significantly.

- Developer flexibility. Strong APIs and transformation capabilities enable custom data pipelines. Engineering teams can build sophisticated workflows that match their exact requirements.

Limitations

- Fewer integrations. RudderStack's catalog has around 200 destinations compared to Segment's 400+. Teams may need to build custom integrations for niche tools.

- Self-hosting overhead. While the open-source option provides control, it requires infrastructure management. Teams need to handle deployment, monitoring, and scaling.

- Less mature product. As a newer platform, RudderStack lacks some of the polish and advanced features of established competitors. Documentation and community resources are growing but limited.

Pricing

RudderStack offers a free tier for up to 500,000 events per month. The Starter plan begins at $750/month for 10 million events. Growth and Enterprise plans provide additional events, sources, destinations, and features with custom pricing.

How it compares

RudderStack costs less than Segment for high-volume scenarios and provides more control through its open-source nature. Compared to Hightouch and Polytomic, RudderStack handles both data collection and activation but is less sophisticated at warehouse-to-tool syncing. The platform requires more technical expertise than Segment or mParticle.

Hightouch

Hightouch pioneered the reverse ETL category, focusing on activating data from your warehouse to downstream tools. Rather than collecting data, Hightouch syncs customer data already in your warehouse to marketing, sales, and analytics platforms.

Best for

Companies with mature data warehouses who want to leverage existing customer data for activation. Hightouch excels when your data team has already built pipelines to centralize customer data in Snowflake, BigQuery, or Redshift.

Strengths

- Warehouse-native approach. Uses your warehouse as the source of truth, eliminating data silos and synchronization issues. No need to maintain a separate customer database.

- Visual workflow builder. Non-technical teams can create syncs using SQL or a visual query builder. This democratizes data access beyond the data engineering team.

- Extensive destination support. Over 200 integrations spanning marketing automation, CRM, analytics, and advertising platforms. New destinations ship regularly.

- Advanced sync capabilities. Features like field mapping, data transformations, and scheduling provide fine-grained control over data activation. Teams can handle complex requirements without custom code.

Limitations

- No data collection. Hightouch doesn't collect event data, so you need separate tools like Segment or RudderStack for that. This means maintaining two platforms.

- Warehouse dependency. Performance depends entirely on your warehouse capabilities. Slow queries or poorly modeled data impact sync reliability.

- Limited for event streaming. While excellent for batch syncs of customer attributes, Hightouch is less suitable for real-time event activation. Streaming use cases require different tools.

Pricing

Hightouch offers a free tier for two syncs and 20,000 rows per month. Paid plans start at $650/month and scale based on the number of rows synced, sync frequency, and destinations. Enterprise plans include advanced features and custom pricing.

How it compares

Hightouch focuses exclusively on data activation while Segment focuses on collection. Compared to traditional CDPs, Hightouch requires more data engineering maturity but offers better integration with your existing warehouse investment.

PostHog

PostHog combines product analytics with CDP capabilities, offering event collection, transformation, and activation within a single platform. The platform provides real-time transformations, webhooks, and integrations alongside analytics, experimentation, and feature flags.

Best for

Product teams wanting analytics and CDP functionality in one platform. PostHog works well for companies that need both product analytics and customer data routing without maintaining separate tools for each function.

Strengths

- Unified platform. Combines product analytics, session replay, feature flags, A/B testing, and CDP in one tool. This reduces vendor sprawl and simplifies data workflows for product teams.

- Real-time transformations. Built-in transformation capabilities enable data enrichment, property mapping, PII scrubbing, and filtering before storage. Teams can clean and standardize data at ingestion time.

- Developer-friendly approach. Open-source foundation with strong documentation and APIs. Engineering teams can self-host or use the cloud offering with full control over their data.

- Broad integration library. Hundreds of pre-built destinations including marketing automation, CRM, data warehouses, and analytics tools. The platform supports webhooks for custom integrations.

Limitations

- Analytics-first design. While the CDP features are solid, PostHog prioritizes product analytics. Teams wanting pure CDP capabilities may find dedicated platforms more focused.

- Less sophisticated identity resolution. Identity management is simpler than specialized CDPs like Segment or mParticle. Cross-device and cross-platform tracking requires more manual configuration.

- Newer CDP capabilities. The CDP features are relatively new compared to PostHog's core analytics product. Some advanced data activation features are still maturing.

Pricing

PostHog offers generous free tiers for each product including 1 million events per month for product analytics. Paid plans start around $0.000225 per event with volume discounts. CDP capabilities are included with product analytics pricing.

How it compares

PostHog differentiates by combining analytics and CDP rather than focusing solely on data routing. Compared to Segment, PostHog costs less and includes analytics but has fewer integrations. Compared to Amplitude with Segment, PostHog provides both capabilities in one platform. The platform makes sense for teams wanting unified product and data infrastructure.

Polytomic

Polytomic is a reverse ETL platform that syncs data from warehouses and databases to business applications. The platform emphasizes developer experience with strong API capabilities and flexible data modeling for technical teams.

Best for

Technical teams needing flexible reverse ETL with robust API support for custom integrations. Polytomic works well for companies that want to programmatically manage data syncs and build custom workflows on top of their warehouse data.

Strengths

- API-first design. Comprehensive APIs enable programmatic control over syncs, models, and configurations. Teams can build custom workflows and automation around their data activation needs.

- Flexible data modeling. Supports complex data transformations and joins directly within the platform. This reduces the need for pre-processing data in the warehouse before syncing.

- Developer-friendly experience. Clean documentation and SDKs make integration straightforward. The platform provides testing environments and detailed error messages for debugging.

- Database source support. Beyond data warehouses, Polytomic can sync from operational databases like PostgreSQL and MySQL. This enables real-time operational data activation.

Limitations

- Smaller ecosystem. Fewer destination integrations compared to Hightouch and Rudderstack. Teams may need to build custom destinations using the API.

- Limited UI for non-technical users. The developer-focused approach makes the platform less accessible for non-technical team members who want to create syncs.

- Newer platform. Less mature than established competitors with a smaller user community. Documentation and examples for edge cases are still developing.

Pricing

Polytomic offers a free tier for limited syncs and data volume. Paid plans start around $500/month and scale based on rows synced, sync frequency, and features. Enterprise plans include advanced capabilities and custom pricing.

How it compares

Polytomic's API-first approach appeals to technical teams more than Hightouch or Rudderstack. The platform offers more flexibility for custom integrations but requires more technical expertise. Compared to RudderStack, Polytomic focuses exclusively on reverse ETL rather than event collection.

Jitsu

Jitsu is an open-source event collection platform that captures data from websites and apps, then routes it to warehouses and downstream tools. The platform provides a lightweight alternative to commercial CDPs with simple deployment options.

Best for

Developers wanting open-source event collection without complex infrastructure requirements. Jitsu works well for teams that want control over their data pipeline while avoiding the operational overhead of traditional open-source CDPs.

Strengths

- Simple deployment. Docker-based deployment makes setup straightforward. Teams can self-host or use Jitsu's cloud offering without extensive infrastructure management.

- Open-source flexibility. Full access to source code enables customization and self-hosting. Teams can audit behavior and extend functionality as needed.

- Lightweight architecture. Minimal resource requirements compared to feature-heavy CDPs. This keeps infrastructure costs low while maintaining core functionality.

- Modern tech stack. Built with modern technologies and provides a clean API. The platform integrates well with contemporary data tools and workflows.

Limitations

- Limited features. Focuses on event collection and routing without advanced capabilities like identity resolution or audience building. Teams need additional tools for sophisticated use cases.

- Smaller integration catalog. Fewer pre-built integrations compared to established CDPs. Custom integration development may be required for less common tools.

- Community-driven support. As an open-source project, support depends on community resources. Enterprise support options are limited compared to commercial alternatives.

Pricing

Jitsu is open-source and free to self-host. The cloud offering provides managed hosting with pricing based on events processed. Costs typically start around $100/month for smaller deployments and scale with volume.

How it compares

Jitsu offers simpler deployment than RudderStack's open-source option but with fewer features. Compared to Segment, Jitsu provides basic event collection at lower cost but lacks polish and integration breadth. The platform works well for teams wanting lightweight data collection without enterprise requirements.

Freshpaint

Freshpaint is a CDP focused on healthcare and privacy-sensitive industries, offering zero-code event tracking with built-in compliance features. The platform automatically captures user interactions without manual instrumentation and provides tools for managing sensitive data.

Best for Healthcare companies and privacy-focused organizations needing compliant data collection without extensive engineering resources. Freshpaint excels when regulatory requirements like HIPAA make traditional tracking approaches complex or risky.

Strengths

- Zero-code tracking. Automatically captures user interactions without manual event instrumentation. Product and analytics teams can track events by pointing and clicking in the UI.

- Healthcare compliance. Built-in HIPAA compliance features including PHI detection and removal. The platform helps healthcare companies collect analytics data while meeting regulatory requirements.

- Privacy controls. Comprehensive tools for managing sensitive data including PII filtering and consent management. Teams can enforce data governance policies without custom development.

- Fast implementation. Auto-tracking reduces implementation time from months to days. Teams can start collecting data immediately and refine tracking over time.

Limitations

- Less control for developers. Auto-tracking provides convenience but reduces precision. Engineering teams may find the abstraction limiting for complex tracking requirements.

- Limited customization. The zero-code approach constrains custom event schemas and data structures. Teams with sophisticated analytics needs may hit Limitations

- Narrow focus. While excellent for healthcare and privacy-sensitive use cases, the platform's features may be overkill for teams without strict compliance requirements.

Pricing

Freshpaint does not publish pricing publicly. Industry reports suggest costs start around $1,000/month for smaller deployments and increase based on event volume and features. Healthcare-specific features may require higher-tier plans.

How it compares

Freshpaint's zero-code tracking differentiates it from developer-focused CDPs like Segment or RudderStack. The healthcare compliance features are unique in the CDP space. Compared to Segment, Freshpaint trades flexibility for ease of use and compliance capabilities. The platform works well for teams where privacy and compliance outweigh the need for custom tracking.

mParticle

mParticle specializes in customer data infrastructure for mobile and omnichannel experiences. The platform provides advanced SDKs for iOS, Android, and web with features like offline queuing and smart batching to optimize mobile performance.

Best for

Mobile-first companies or retailers with complex cross-channel requirements. mParticle excels when you need sophisticated mobile app tracking, cross-device identity resolution, and integration with mobile marketing platforms.

Strengths

- Mobile-first architecture. Purpose-built mobile SDKs handle offline scenarios, battery optimization, and network constraints better than web-focused CDPs. The platform automatically batches events to reduce battery drain.

- Advanced identity resolution. Sophisticated identity graph resolves users across mobile apps, web, email, and in-store interactions. This becomes valuable for omnichannel retailers and multi-platform products.

- Data quality features. Built-in data planning and governance tools help teams define and enforce data schemas. The platform catches implementation issues before they reach production.

- Audience building. Strong audience segmentation capabilities enable complex user cohorts without writing SQL. Audiences sync to marketing and analytics platforms in real-time.

Limitations

- Higher cost structure. mParticle's pricing is generally higher than competitors, with costs tied to data volume and features. Companies often find it expensive relative to alternatives.

- Complexity overhead. The platform's extensive features create a learning curve. Teams need time to understand data planning, identity resolution configuration, and audience management.

- Integration depth varies. While mParticle offers many integrations, the quality and feature support varies significantly across partners. Some integrations lack important capabilities.

Pricing

mParticle does not publish pricing publicly. Based on industry reports, costs typically start around $1,200/month for smaller deployments and scale significantly with data volume. Enterprise contracts often exceed $100,000 annually.

How it compares

mParticle's mobile capabilities exceed Segment's, but it costs more and has fewer integrations. Compared to Lytics, mParticle offers better data infrastructure but less sophisticated AI-driven insights. The platform is more complex than RudderStack but provides more out-of-the-box features.

Lytics

Lytics combines CDP capabilities with AI-driven customer intelligence and activation. The platform focuses on helping marketing teams build sophisticated customer segments and orchestrate personalized experiences.

Best for

Marketing teams wanting AI-powered customer insights without deep technical resources. Lytics excels when marketing owns customer data activation and needs advanced segmentation without writing SQL or depending on engineering.

Strengths

- AI-driven insights. Machine learning models predict customer behavior, score engagement, and recommend segments. This helps marketing teams discover opportunities they might miss manually.

- Marketing-friendly interface. Built for marketing users with visual tools for segmentation, journey mapping, and campaign management. Less technical expertise required than engineering-focused CDPs.

- Real-time personalization. The platform enables personalized web and email experiences based on customer data. Teams can serve different content to different segments without custom development.

- Content affinity tracking. Automatically tracks content engagement and builds interest profiles. This helps tailor messaging based on topic preferences and behavior patterns.

Limitations

- Limited technical flexibility. While approachable for marketers, the platform offers less control for engineering teams who want custom pipelines or transformations.

- Smaller integration ecosystem. Fewer pre-built integrations than Segment or mParticle. Teams may need custom development for less common tools.

- AI opacity. The machine learning models work as black boxes, making it difficult to understand why certain recommendations appear or how to optimize results.

Pricing

Lytics does not publish pricing publicly. Industry reports suggest costs start around $2,000/month for smaller deployments and increase significantly based on data volume, features, and users.

How it compares

Lytics targets marketers while Segment targets engineers. The AI capabilities exceed most CDPs, but the platform offers less technical control. Compared to mParticle, Lytics has stronger marketing features but weaker mobile capabilities. The platform works best alongside rather than replacing traditional CDPs.

Tealium

Tealium combines tag management with CDP capabilities, providing both client-side data collection and customer data unification. The platform serves enterprises needing centralized control over marketing tags and customer data.

Best for

Large enterprises with complex martech stacks who need both tag management and CDP capabilities. Tealium works well for companies with multiple brands, regions, or business units requiring centralized governance.

Strengths

- Unified platform. Combines tag management, CDP, and audience management in one platform. This reduces the number of vendors and simplifies data governance.

- Enterprise features. Strong privacy controls, consent management, and audit capabilities meet enterprise compliance requirements. The platform supports multi-tenant configurations for large organizations.

- Extensive integrations. Over 1,300 integrations spanning tags, server-side connections, and audience destinations. This breadth covers most enterprise martech needs.

- Universal Data Hub. The data layer approach standardizes data across all tools and touchpoints. This ensures consistency and simplifies integration management.

Limitations

- Complexity and cost. Tealium is expensive and complex to implement. Enterprises should expect long implementation timelines and significant investment in training and configuration.

- Performance concerns. Tag management can impact page load times if not carefully managed. Teams need to monitor performance and optimize tag configurations regularly.

- Overlapping capabilities. For companies that don't need tag management, paying for those features adds unnecessary cost. Purpose-built CDPs may provide better value.

Pricing

Tealium does not publish pricing publicly. Based on industry reports, annual contracts typically start around $50,000 for smaller deployments and can exceed $500,000 for large enterprise implementations with full feature access.

How it compares

Tealium's tag management differentiates it from pure CDPs like Segment or mParticle. The platform is more expensive and complex but provides unified governance. Compared to Lytics, Tealium has better technical infrastructure but less sophisticated AI. The platform makes sense for enterprises needing both tag management and CDP capabilities.

How to choose the right customer data platform

Small teams with basic needs. Start with RudderStack's free tier, Segment's free plan, or Jitsu for lightweight open-source collection. All three provide solid data collection without significant investment. Focus on getting data flowing before worrying about advanced features.

Enterprise with complex requirements. Consider Segment for maximum integration coverage and reliability, or mParticle if mobile is critical. Enterprises should also evaluate Tealium if tag management is a requirement. Budget for significant investment in implementation and training.

Technical teams prioritizing control. RudderStack's open-source approach provides maximum flexibility and data ownership. Polytomic offers strong API capabilities for programmatic data activation. Teams comfortable with infrastructure management will appreciate the control and cost savings at scale.

Data warehouse-first companies. Use Hightouch or Polytomic for reverse ETL if your warehouse already contains customer data. This approach leverages existing investments and avoids data duplication. You'll still need separate tools for event collection.

Marketing teams needing autonomy. Lytics provides marketing-friendly segmentation and AI-driven insights without requiring engineering support. This works well when marketing owns customer data activation and doesn't want to depend on technical teams.

Mobile-first products. mParticle's mobile-optimized SDKs and cross-device identity resolution justify the premium pricing. Companies with complex mobile apps or multiple platforms benefit from the platform's mobile expertise.

Budget-constrained teams. RudderStack, Segment's free tiers, or Jitsu's open-source option provide the most value for limited budgets. As you scale, RudderStack's event-based pricing often costs less than Segment's MTU model for high-volume scenarios.

Compliance-heavy industries. Freshpaint stands out for healthcare with built-in HIPAA compliance and PHI management. All major CDPs support GDPR and CCPA, but Segment, mParticle, and Tealium provide the most comprehensive privacy and consent management features for other industries. Evaluate specific compliance requirements against platform capabilities.

Customer data platform FAQs

What's the difference between a CDP and a data warehouse? A CDP collects, processes, and routes real-time customer data to other tools. A data warehouse stores and analyzes historical data. Many modern architectures use both, with CDPs handling real-time collection and warehouses providing analytical capabilities. Warehouse-native CDPs like RudderStack and reverse ETL tools like Hightouch blur these lines.

Can I use multiple CDPs together? While possible, using multiple CDPs adds complexity and cost without clear benefits. More common is pairing a collection-focused CDP like Segment with a reverse ETL tool like Hightouch. This gives you both real-time event collection and warehouse-to-tool activation. Evaluate whether the added complexity justifies the benefits.

How long does CDP implementation take? Basic implementation of tracking and a few integrations takes weeks. Comprehensive implementations with identity resolution, data governance, and complex destinations take months. Implementation time depends on your data maturity, technical resources, and requirements. Plan for ongoing maintenance as your data needs evolve.

Do I need a CDP if I have Google Analytics? Google Analytics provides website analytics but doesn't route data to other tools or unify customer profiles across platforms. A CDP complements analytics by collecting data once and sending it everywhere you need it. This becomes valuable when you use multiple tools or need custom integrations.

What's the ROI of a CDP? CDPs save engineering time by eliminating custom integrations and reduce data discrepancies by providing a single source of truth. Quantify ROI by calculating integration development time saved, marketing efficiency gains from better segmentation, and revenue impact from improved personalization. Most companies see positive ROI within a year.

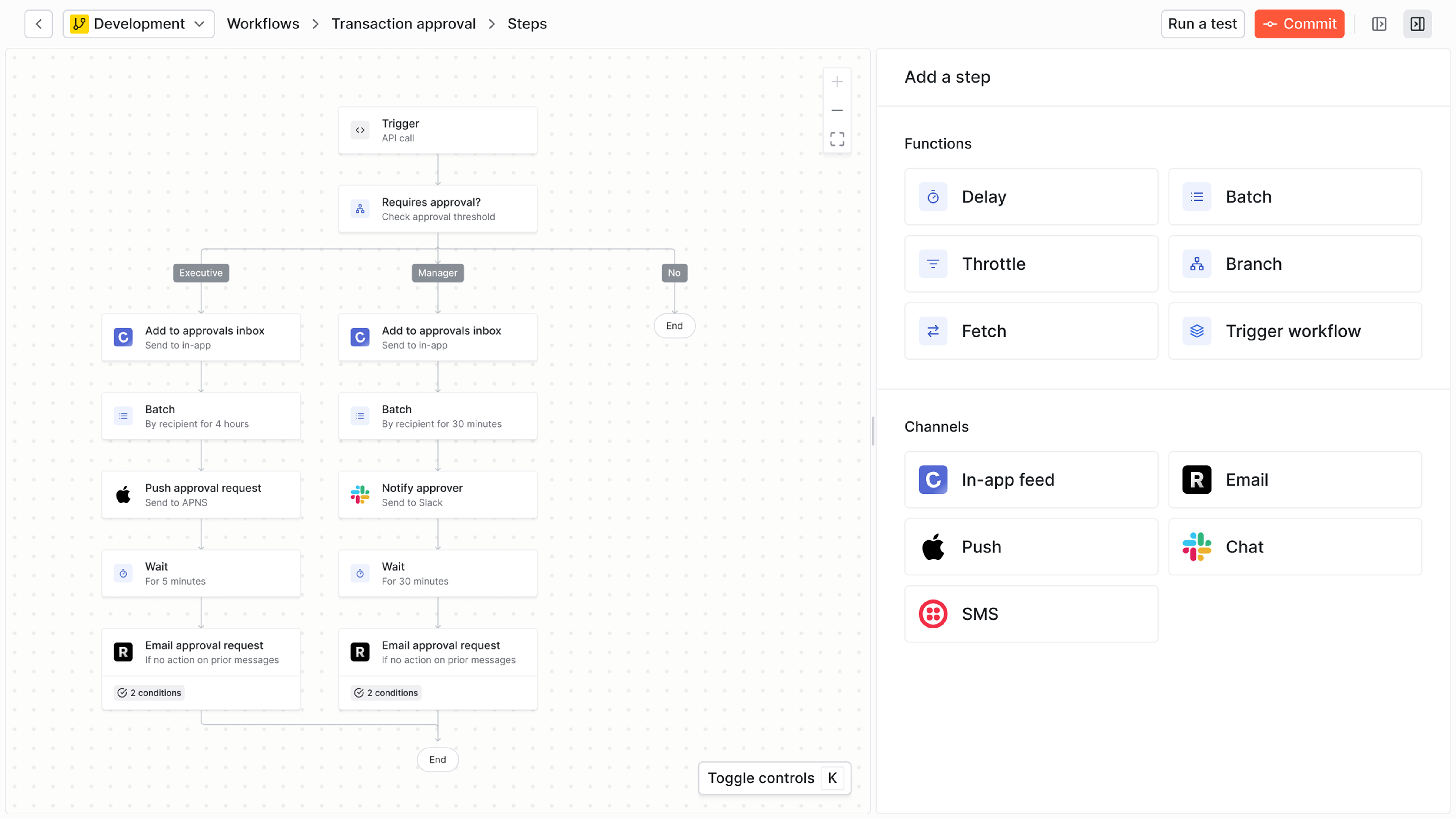

Using CDPs with messaging infrastructure

After using your CDP to build customer segments and capture events, you need infrastructure that can use that data to trigger and deliver messaging to these customers.

Messaging infrastructure solutions, like Knock, complement your CDP by ingesting the data and handling the complexity of delivering notifications across email, SMS, push, in-app, and Slack. This includes intelligent batching, user preferences, full observability, and more.

Knock integrates directly with major CDPs like Segment, RudderStack, and more, so product, growth, and engineering teams can access their customer data to start triggering messages in days instead of months.

Start building with Knock today or talk to our team to learn how Knock can improve your customer engagement infrastructure.